indiana excise tax deduction

Indiana deductions are used to reduce the amount of taxable income. The tax is collected and remitted to DOR by the 15 th day of the.

How Do State And Local Sales Taxes Work Tax Policy Center

This type of equipment was previously.

. Excise taxes imposed on personal property vehicles campers boats RVs etc are an allowable deduction if two conditions are met. Heavy Equipment Rental Excise Tax If your business rents heavy equipment youll need to register and collect a 225 heavy equipment rental excise tax. It is not too surprising.

A portion of Indianas vehicle registration fees are tax deductible. Indiana Department of Revenue Indiana Farm Winery Excise Tax Schedule Name As It Appears on Permit Federal Identification Number Reporting MonthYear Transaction Type A -. Vehicle Excise Tax Deduction for Disabled Veterans.

But this amount is actually called an excise tax and not a property tax. Passenger Vehicle Excise Tax Fees The excise tax amount is based on the vehicle class and age. If you are youll claim them.

A portion of Indianas vehicle registration fees are tax deductible. The excise tax is determined by the. Those included the Social Security deduction 10548 average deduction per return and the dependent child exemption 2619 average exemption per return.

The Indiana state registration fee and the auto sales tax itself is not deductible but all or a portion of the excise taxes you pay may be deductible on Form 1040 Schedule A. First check the list below to see if youre eligible to claim any of the deductions. The IRS only allows that portion of a.

The excise tax credit is equal to the lesser of the excise tax due for the specific vehicle or 70 and can be applied to two vehicles owned by the veteran. 1 The amount of excise tax liability for the individuals vehicle under section 5 of IC 6-6-5 2 Seventy dollars 70 The maximum number of motor vehicles is two 2 The credit. But this amount is actually called an excise tax and not a property tax.

Many of our county. But this amount is actually called an excise tax and not a property tax. EDT for routine maintenance.

Excise Tax CreditsRefunds for Vehicles Sold or Destroyed Excise Tax CreditRefunds for Vehicles Registered in a Different State Bureau of Motor Vehicles Indiana Government Center North 4th. The IRS only allows that portion of a. All Indiana veterans may deduct 14000 from the value of their home before calculating property taxes.

A portion of Indianas vehicle registration fees are tax deductible. Wartime Indiana veterans may deduct even morenearly 25000. It is based on the value of vehicle.

Application for deductions must be completed and dated not later than December 31. The age of a vehicle is determined by subtracting the model year from the calendar year that. The excise tax is collected by retailers of aviation fuel purchased in Indiana at the rate of twenty cents 020 per gallon.

Deductions work by reducing the amount of assessed value a taxpayer pays on a given parcel of property. By clicking the login button I swear or affirm that I. Veterans or their Spouse that are eligible for any of the deductions above but the assessed value of their.

How Alcohol Taxes Figure Into Your Margarita Day Celebration Don T Mess With Taxes

How Do State And Local Sales Taxes Work Tax Policy Center

Fall Into Deductions Assessors Conference Mike Duffy General Counsel August Ppt Download

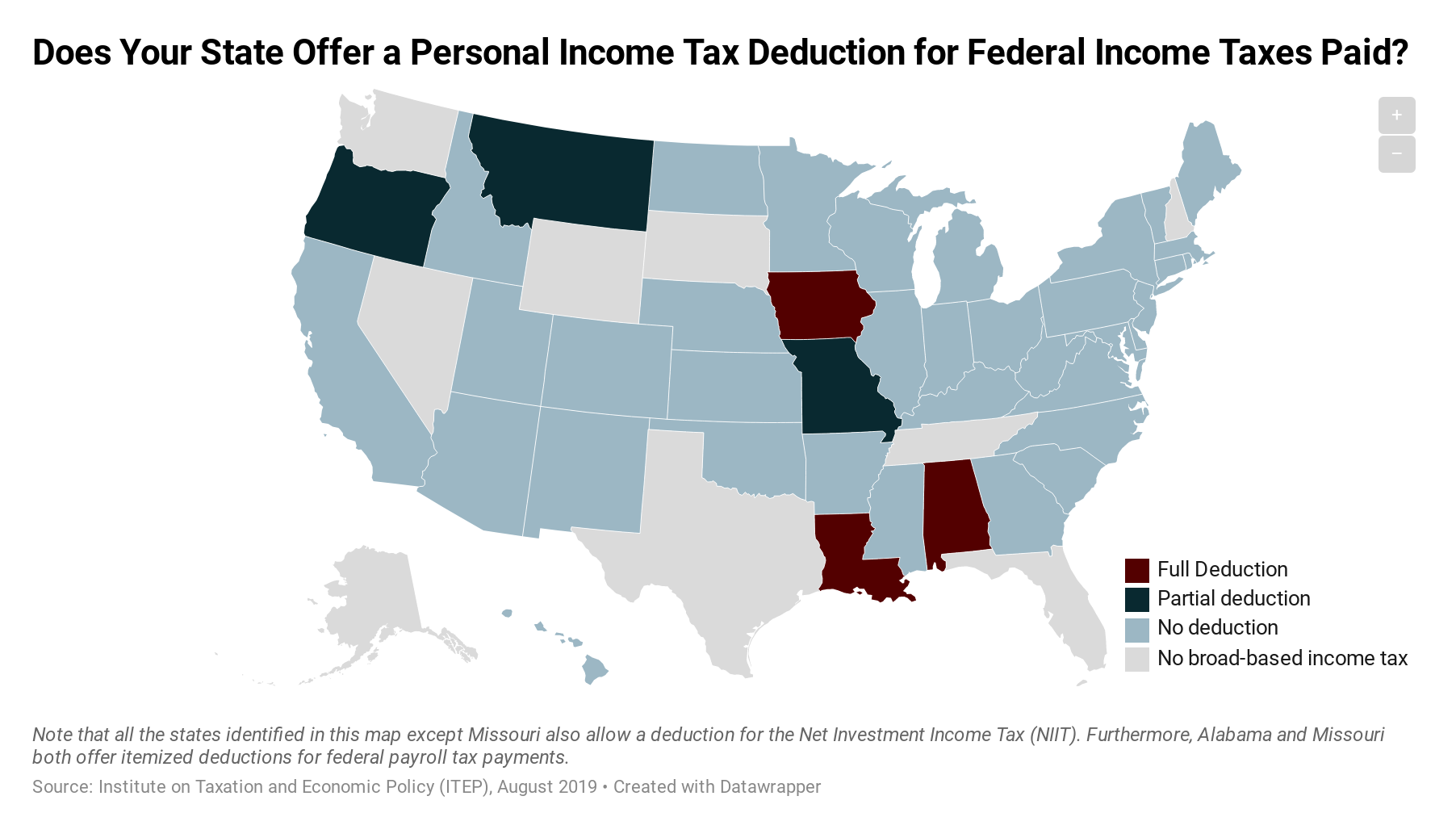

Which States Allow Deductions For Federal Income Taxes Paid Itep

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

Excise Taxes Excise Tax Trends Tax Foundation

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

3 11 23 Excise Tax Returns Internal Revenue Service

State And Local Tax Advisor May 2022 Our Insights Plante Moran

2022 State Tax Reform State Tax Relief Rebate Checks

Bills That Need Our Help Archives Dav Carlos Arambula Chapter 102

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

Indiana Cigarette Tax Hike May Increase Cigarette Smuggling

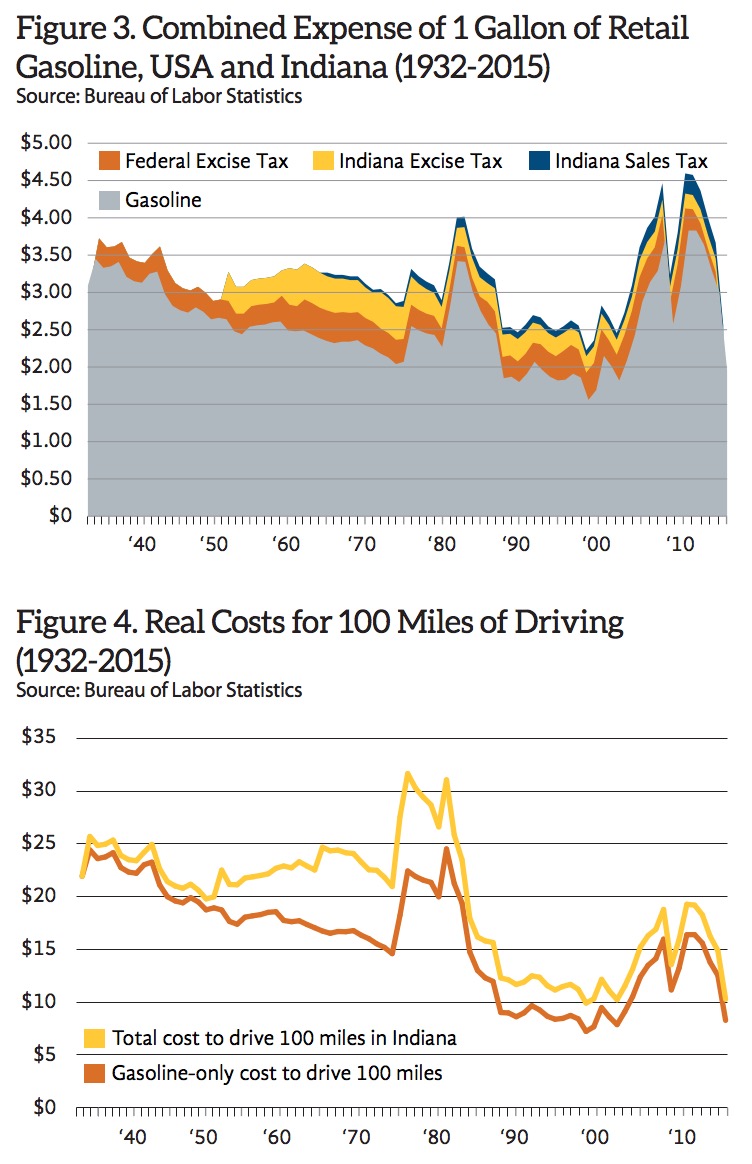

Indiana History And Analysis Of Gas Taxes Infrastructureusa Citizen Dialogue About Civil Infrastructure

Application For Tax Deduction For Disabled Veterans Wwi Veterans And

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger